What is Sustainable MPS?

Sustainable MPS offers a suite of diversified portfolios that meet a range of objectives and risk profiles, and which are aligned to RBC Brewin Dolphin’s responsible investment philosophy.

The primary objective of Sustainable MPS is to maximise returns from income and capital growth from a portfolio of funds that exclude exposure to certain controversial sectors.

The portfolios will also seek exposure to companies that have a positive societal or environmental impact. The Sustainable MPS portfolios are managed by the same expert team behind our proven MPS service.

Key facts about Sustainable MPS

A choice of five risk-managed portfolios

Active asset allocation of lower-cost passive funds

Management fee of 0.3% with low charges on underlying funds

Robust and repeatable investment processes

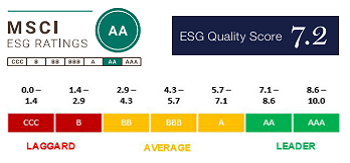

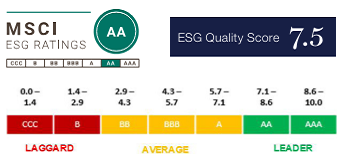

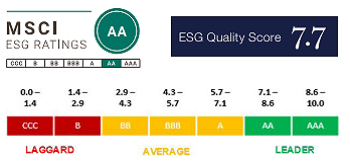

Each portfolio’s ESG score is independently assessed by MSCI and holdings are UN PRI signatories

All portfolios are risk-mapped against Dynamic Planner, Defaqto, EValue, Finametrica, MorningStar, Oxford Risk and Synaptic

Why choose Sustainable MPS?

Positive contribution

Our sustainable MPS is an investment management service that offers investors the opportunity to avoid investment in certain harmful sectors and utilise funds that invest in companies which contribute positively to global environmental and social sustainability challenges.

Selective choice of funds

We offer a suite of diversified portfolios that meet a range of objectives and risk profiles, and which are aligned to our responsible investment philosophy.

Independently assessed

We believe transparency is important. This is why we use the UN Sustainable Development Goal alignment scores from MSCI, a leading specialist independent rating agency, to illustrate the positive contribution of our Sustainable MPS portfolios.

Our five portfolios

Income

Income higher equity

Balanced

Growth

Global equity

The above ratings are correct as at May 2024. For the latest ratings, please refer to our factsheets. MSCI’s ESG ratings are designed to measure a company’s resilience to financially material environmental, societal and governance risks. They are not meant to serve as measure of corporate goodness, a barometer on any single issue or a synonym for sustainable investing.

Certain information ©2022 MSCI ESG Research LLC. Reproduced by permission.

Sustainable MPS – Investment process

As a signatory of the United Nations Principles for Responsible Investment (UNPRI), we ensure that the investment fund managers selected for inclusion also promise to incorporate ESG factors into their investment decisions and are active investment owners.

We also run a qualitative screen, which considers financial and non-traditional risks, our exclusion policies, and also including ESG risks and opportunities.

The team selects funds which are industry leaders in integrating ESG factors into investment decisions and stewardship activities, and funds that invest in companies which contribute positively and measurably to social and/or environmental challenges.

Rebalancing dates

| Q1 2025 | Q2 2025 | Q3 2025 | Q4 2025 |

|---|---|---|---|

| 13 January 2025 | 14 April 2025 | 7 July 2025 | 13 October 2025 |

| 10 February 2025 | 12 May 2025 | 11 August 2025 | 10 November 2025 |

| 10 March 2025 | 9 June 2025 | 8 September 2025 | 8 December 2025 |

Why choose RBC Brewin Dolphin?

Trusted

1,700 adviser partners

Expert

Voted top of our field

Established

Our firm dates back to 1762

Your clients’ investments are in safe hands

Gold rating for our Discretionary Fund Management service

A five star rating for our DFM MPS on Platform service

A five diamond rating for our DFM MPS (Platform) Family service

Research team

Our research team’s investment philosophy and process forms the foundation for all our services.

Research philosophy

Our in-house research team identifies, analyses and monitors the best investments to enable us to preserve and grow your clients’ money over the long term and respond quickly to market events.

Find out moreResearch investment process

Discover our rigorous, independent and dynamic investment management process, which reduces the regulatory and compliance burden, so you can focus on your clients.

Find out moreOur services

We offer a range of services to help you meet the needs of each client.