Why families should talk about inheritance

Inheritance and estate planning Views & insightsAvoiding inheritance conversations could result in misplaced expectations and disputes. Here’s how to broach the subject

21 June 2024 | 3 minute read

Talking to your family about what will happen to your estate when you die is a difficult conversation to have.

But avoiding conversations about inheritance could result in misplaced expectations, family disputes, and missed financial planning opportunities.

|

|

||

Download: A guide to inheritance tax planningEverything you need to know about leaving a tax-efficient legacy for your loved ones. |

||

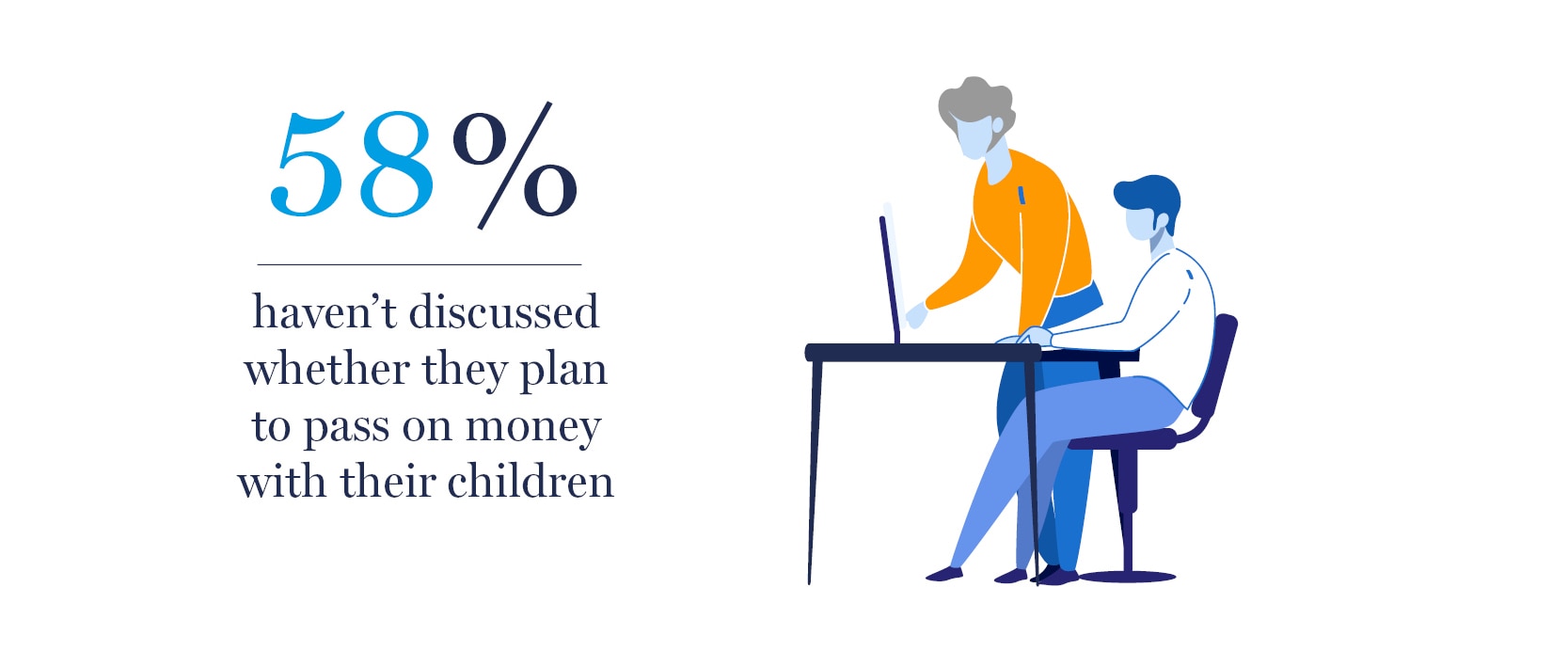

The expectations gap

We conducted some research1 of 7,000 people – 2,000 of whom were over-55 with children, and 5,000 of whom were under-55 with living parents – to understand the attitudes between different generations around inheritance. We found that many parents and children were not talking to one another about inheritance, and that there was an ‘expectations gap’ between the two generations.

Even those with sizeable estates were neglecting to broach the subject. For example, more than two-fifths of parents with £1m+ in savings and investments hadn’t discussed whether they plan to pass on money with their children. Among children, three-quarters said they hadn’t had that conversation.

Perhaps unsurprisingly, those surveyed had very different expectations when it came to passing on wealth. Almost half of children said they ‘never’ expect to receive financial help from their parents, whereas more than nine in ten parents with £1m+ in savings and investments intend to pass on wealth during their lifetime or when they die.

Importance of open conversations

Failing to talk about inheritance could mean that your children simply don’t know what to expect, making it harder for them to plan for their future. They may also find it difficult to understand why you’ve made certain decisions, which could lead to confusion and conflict. There’s also the risk that you don’t make as valuable a contribution as you were hoping to; for example, it may be the case that your children and grandchildren would benefit more from lifetime gifts than an inheritance via your will.

Broaching the subject and being open about your wishes will help to ensure everyone is on the same page. An open conversation will also help you understand any challenges your loved ones may be facing, enabling you to make a more fully informed decision about the best time to pass on your wealth. It could even throw up financial planning opportunities. For instance, if your children need support with buying a property or funding grandchildren’s education fees, a carefully considered lifetime gifting plan could allow you to pass on a bigger financial legacy, while also helping to mitigate inheritance tax (IHT).

How to broach the subject

Broaching the subject of inheritance isn’t easy, but it might help to position the conversation as being about opportunities, not mortality. Having a financial adviser in the room can help the conversation go more smoothly. Experienced advisers understand that inheritance can be an emotional topic; they are skilled at guiding families through the discussion and drawing out what each person may want or need. They’ll explain the ins and outs of complex matters like lifetime gifts, trusts, and whole of life insurance, so that everyone understands why certain plans are being put in place. They’ll also help to answer any questions you and your family may have.

Next steps

It’s only natural to want to offer financial support to your children and grandchildren. But the first place to start should always be an honest conversation. That way, you’ll understand what kind of support your family would really benefit from and, with the help of an adviser, be able to create an estate plan that suits everyone’s needs.

1 Find Out Now survey, March to April 2023

|

|

||

Get financial planning tips straight to your inboxSign up to our newsletter for expert insights on investing for the future, saving for retirement, passing on assets to the next generation, and much more. |

||

The value of investments, and any income from them, can fall and you may get back less than you invested. This does not constitute tax or legal advice. Tax treatment depends on the individual circumstances of each client and may be subject to change in the future. Information is provided only as an example and is not a recommendation to pursue a particular strategy. Information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness.

Tagged with

Is your legacy tax efficient?

We can help you pass on your assets securely and efficiently to the people you care about.

IHT planning