Trump’s trade offensive: What investors need to know

Market news Views & insightsDon't let trade uncertainty derail your investments. Chief Strategist Guy Foster breaks down President Trump’s new tariffs, offering clarity on what they mean for the economy and your portfolio.

4 April 2025 | 9 minute read

Key highlights

- Tariff escalation: A 10% tariff will apply to all countries, but trading partners like China, Japan and Europe will face rates two and three times as high.

- Impact felt globally: The tariffs are an effort to boost U.S. manufacturing and address trade imbalances, but there are fears they will hike consumer prices, disrupt global supply chains, and lead to trade wars.

- Stocks see red: Equity markets around the world fell into the red, but the impact on companies is complex and varies stock by stock, depending on where firms manufacture their goods.

What has happened?

After weeks of anticipation and speculation, President Donald Trump’s ‘Liberation Day’ announcement unveiled trade measures toward the more extreme end of expectations. We’ll avoid reprising what is widely available in the press, but it’s worth a quick reminder of the background behind Wednesday’s executive order.

Early in his second term, President Trump ordered the U.S. Trade Representative (USTR) to investigate potential trade frictions imposed by America’s trading partners, aiming to identify instances where their exports to the U.S. gained an unfair advantage over U.S. exports. He requested a thorough review into not only tariffs, but also non-tariff barriers.

Despite decades of progress in reducing tariffs and trade barriers, there remain frictions, and to some extent these are inevitable.

What has been announced?

At the end of March, the USTR’s report, the 2025 National Trade Estimate, highlighted a seemingly global trend: every country exerts protectionist policies. However, the report did not measure the effect of these policies. Instead, it assumed an effective tariff rate which was based upon how large that country’s trade surplus with the U.S. was. Bizarrely, for countries with no trade surplus, or even a trade deficit, the effective tariff rate was assumed to be 10%.

As a result, the U.S. is implementing so-called reciprocal measures.

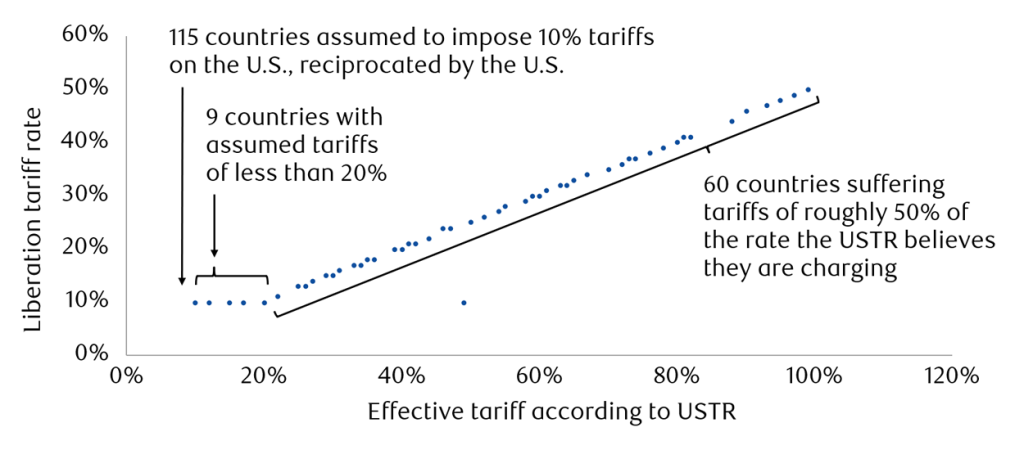

Specifically, the U.S. will fully reciprocate the 10% effective tariff imposed by 115 countries on U.S. imports. For 75 countries with effective tariffs exceeding 10%, the U.S. will partially reciprocate with tariffs ranging from 10% to 50%.

These tariffs follow the metal imports tariffs President Trump introduced during his first term. This year, he’s raised tariffs on China three times, resulting in a cumulative rate of more than 60% since the start of his first term. This includes tariffs related to fentanyl imports, which also apply to Canada and Mexico. Additionally, sector specific tariffs of 25% have been announced on U.S. imports of steel, aluminium, cars, and car parts. The impact of the tariffs is considerable. During these first months of his second term, the average tariff on U.S. imports has risen by around 20%. And President Trump isn’t stopping there; he’s indicated that further tariffs are planned to cover pharmaceuticals, semiconductors, lumber, and copper.

‘Liberation Day’ tariffs were mostly at a flat rate of 10% or half of the effective tariff estimated by the U.S. Trade Representative.

Note: Some countries are subject to the same tariff so one dot may represent several countries.

Source: USTR

How will this affect the economy?

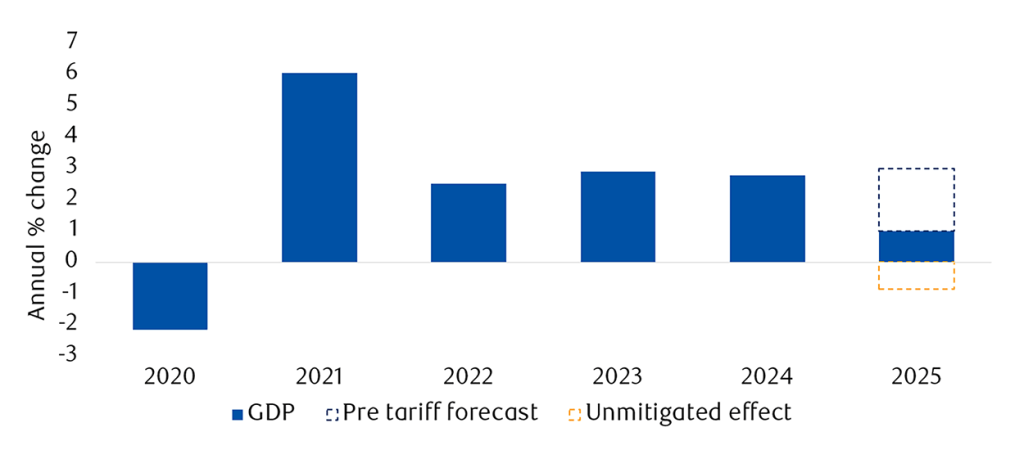

Best estimates indicate these tariffs could reduce U.S. GDP by as much as 3%, but we can assume a lot of this will be mitigated by recycling the tax revenue from tariffs back into the economy. When the Congressional Budget Office forecasts the sustainability of tax cuts, we don’t believe they’ll be able to include this revenue given the tariffs were imposed under emergency, rather than permanent, legislation. Nevertheless, we assume this tax revenue will somehow be fed back into the economy, which will partially offset the pain of these measures. U.S. GDP is now only expected to grow by around 1% over the next year, although the risks are to the downside.

The impact on prices is harder to mitigate, so inflation may be 1% to 1.5% higher as a result.

Ordinarily, we would expect currency appreciation from the country imposing a tariff (as fewer dollars get exchanged for foreign currency to buy imports). It’s therefore striking that the dollar has fallen sharply since it became clear President Trump would implement tariffs on countries simultaneously. This reflects the fact that U.S. growth is expected to suffer more than the growth of its trading partners.

The U.S. can expect higher taxes and prices relative to its trade, and will also face retaliatory measures; China has already announced additional tariffs of 34% on U.S. imports. Comparatively, trading partners will only suffer this in relation to their trade with the U.S.

The effective tax increase and price increase will reduce U.S. GDP. Retaliation could make this worse, tax cuts could lessen the impact.

Source: IMF/RBC BD

The Federal Reserve will probably cut U.S. interest rates this year, although with inflation potentially breaching 4% during 2025, it won’t be an easy decision, especially with the weak dollar. In Europe, the European Central Bank and Bank of England are quite likely to cut interest rates at their next meeting

How will tariffs impact the UK?

It’s a peculiar reflection of the situation that the UK, which does not run a meaningful trade surplus with the U.S., can be considered to have escaped the wrath of President Trump’s administration by only suffering a 10% tariff on exports to the U.S. In reality, however, the direct impact of these measures seems likely to be modest, not least because competing producers will be in a similar or worse position. The indirect effects are much harder to model. At the time of writing, the UK government has hinted at retaliation but stopped short of declaring it.

Will tariffs be successful in reducing the U.S. trade deficit?

To some extent they will, but historically the U.S. trade deficit has contracted at times when the U.S. economy has slowed, so it could seem like a pyrrhic victory.

The reason the U.S. runs a trade deficit is because American consumers spend more than they save, a situation made possible by the Federal government spending more than it collects in tax revenue. Interestingly, while the tariffs are substantial, they probably aren’t enough for exports from most emerging economies to become uncompetitive relative to U.S. manufacturing.

U.S. productive capacity is insufficient to meet its domestic demand, and that situation will only worsen due to immigration curbs. Without immigration, America’s working age population is projected to start declining. Therefore, it seems unlikely that these policies will spark the manufacturing revolution President Trump is trying to achieve.

How will investments be impacted?

Markets have been bracing themselves for this announcement for weeks. Now that it’s landed, it has proven to be towards the more extreme end of what investors considered possible, and that has weighed on markets.

From an equities perspective, the impact on companies is complex and varies stock by stock. The impact doesn’t depend on where companies’ shares are listed, or even where they sell their goods, but rather where they manufacture their goods.

Notably, the Magnificent Seven – the mega-cap, U.S. technology-enabled companies – have seen a pullback in their exceptional gains. While most don’t appear directly exposed to tariffs, rising uncertainty often leads investors to take profits. Tariffs on Vietnam will hit Apple though (down 9% after the announcement), which stands out as the epitome of U.S. exceptionalism, as well as Nike (down 14%).

Following two years of strong stock market returns, this period of volatility reminds us why investors need defensive assets within their portfolios. Gold has provided good protection, though investors are currently taking profits, probably because they knew gold was exempted from tariffs. Tight corporate spreads leave credit vulnerable if the world is going to experience a growth shock, so we recommend an underweight position, while our overweight position in sovereign bonds should benefit.

What happens next?

Above all, the two key truths about President Trump have been reinforced and remain as relevant now as ever:

- He firmly believes in tariffs as a tool to empower U.S. industry

- He loves to negotiate

There’s no question that these tariffs negatively impact the global economy. While trade has environmental and social consequences, its overall economic effect is positive, and curtailing it creates a headwind.

There is hope yet, though.

As mentioned, countries with net exports to the U.S. are assumed to be imposing protectionist policies, whereas countries with net U.S. imports are also being hit by U.S. protectionism. This double standard might seem outrageous, but in reality, any country is free to impose whatever trade restriction it wants on another country, as long as it’s prepared to live with the consequences. Therefore, this situation bears all the hallmarks of an outlandish opening gambit from an arch dealmaker.

President Trump has already signalled his willingness to negotiate, and the unpopularity of additional price rises should encourage him to do so. In his book, The Art of the Deal, he says “I always go in with a very low offer, and I always assume that the other side will negotiate. I believe that the other side will want to make a deal, and I’m willing to negotiate.”

It therefore seems likely that we’ll see a reduction in these tariff rates, and they’ll probably be announced with great fanfare.

The value of investments, and any income from them, can fall and you may get back less than you invested. This does not constitute tax or legal advice. Tax treatment depends on the individual circumstances of each client and may be subject to change in the future. You should always check the tax implications with an accountant or tax specialist. Neither simulated nor actual past performance are reliable indicators of future performance. Investment values may increase or decrease as a result of currency fluctuations. Information is provided only as an example and is not a recommendation to pursue a particular strategy. Forecasts are not a reliable indicator of future performance. We or a connected person may have positions in or options on the securities mentioned herein or may buy, sell or offer to make a purchase or sale of such securities from time to time. For further information, please refer to our conflicts policy which is available on request or can be accessed via our website at www.brewin.co.uk. Information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness.

Tagged with

Ideas Happen Here

Let’s build your financial future so you can focus on what really matters. Contact us for help with financial planning and investment management.

Book a call back