Menopause and money: Why financial planning is important

Financial planning Views & insightsAs you adapt to the changes menopause brings, don't overlook your financial wellbeing. Learn how to prepare and protect your finances.

6 March 2025 | 3 minute read

Much has rightly been written about how women are often at a disadvantage to men when it comes to building savings and pensions over a lifetime. This is typically attributed to a variety of reasons, such as the gender pay gap and the fact that women often take time out of work to be primary caregivers, be that for children or for elderly parents.

Until recently, however, very little has been said about the impact of the menopause on women’s finances – indeed, the menopause has remained a largely taboo subject. However, thanks to awareness raising by celebrities such as TV presenter Davina McCall and the work of campaigners for women’s issues, the menopause is increasingly being discussed.

The reality is that the vast majority of women will experience menopause symptoms. These can be wide-ranging and may include anxiety, brain fog, depression, memory problems, joint pain, hot flushes and fatigue. All of these can be extremely debilitating and may directly affect a woman’s ability to work, with a subsequent impact on her finances.

Researchers at the University of Southampton in England analysed data from a longitudinal study of over 3,000 women and found that more than half of women aged 50 suffer at least one disruptive menopausal symptom. Women experiencing severe menopausal symptoms were 43% more likely to have left their jobs by the age of 55 than those without such symptoms, and 23% percent more likely to have reduced their working hours.

How does the menopause impact work and finances?

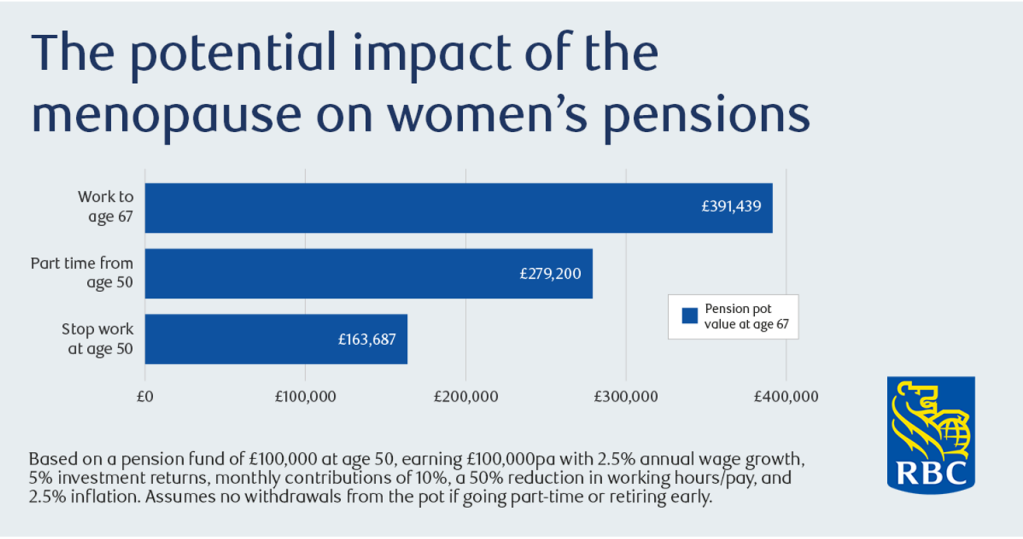

The impact of the menopause on finances will largely depend on whether a woman has to take time out of work or stop working altogether. This will typically result in a reduced income or no income at all for a set amount of time. Not only might this influence a woman’s ability to contribute to savings and pensions but it may actually result in them having to withdraw money from savings to cover expenditure. The potential loss to a pension and retirement planning can be significant, as this chart illustrates.

But the impact can be much further reaching. Many women feel a distinct loss of confidence while going through the menopause – this can slow down career progression as they may be put off going for a promotion. Indeed, research from the UK government reveals that 27% of women say the menopause has had a negative effect on their career progression.

Maria Evandrou, Professor of Gerontology at the University of Southampton, who has studied aging and life course events for 30 years, says: “Many women don’t feel confident talking about the menopause in the workplace in case they are viewed as potentially not competent to be given a higher-level task or more senior role. They don’t know how it is going to be received.”

This lack of career progression would potentially result in a loss of future earnings – money that would have been in the bank had they progressed up the career ladder.

It’s also essential to note that in a marriage or partnership, a woman may be the main breadwinner (or possibly the main breadwinner going forward), potentially earning a higher salary and contributing more to joint savings, mortgage payments and expenditure. This could result in a significant financial impact on the family.

At the most extreme end of financial impact is the potential for divorce. As Jane Falkingham, Professor of Demography and International Social Policy at the University of Southampton, explains: “It’s not only the woman who experiences the menopause, it’s the whole family. A number of women we have spoken to have said, ‘if I knew what I know now, then maybe my marriage would have been healthier’. And some people even said ‘maybe we would have stayed together’.”

How to plan for the menopause

While most women will go through the menopause, every woman’s experience is going to be very personal to them. The average age for a woman to reach menopause is 51, but symptoms can begin years or even a decade earlier, during what’s known as the perimenopause.

The severity of the menopause is also an unknown. As mentioned earlier, some women will suffer moderate symptoms that may not impact on their work too adversely. However, some will have to stop work altogether – be that on a permanent or temporary basis. This makes financial planning all the more challenging.

But as Annabel Bosman, Regional Centre Head – London and South-East, RBC Wealth Management Europe, explains, the menopause is one of several common life events that can adversely affect your financial profile. “The reality is that many women will likely have to take some time out of work in their lives, be that to raise children, take care of a sick relative or because of the menopause,” she says. “This is where the value of financial planning really shows – factoring in these obstacles at the outset of your planning can help fortify you against such disruption.”

By building in cash buffers or rainy days funds, maxing out savings and pensions, and making the most of tax incentives, such as ISAs, as early as you can, it’s possible to ride out the ebbs and flows of life. “I think this is about back-to-basics financial planning,” says Bosman.

“We want to help clients plan for their best life, but also acknowledge that there will be dips along the way,” says Shazna Bishop, Financial Planner and Divisional Director, RBC Brewin Dolphin. “If you have to reduce the days you work, go part-time or stop work for certain periods, for whatever reason, it’s essential to build that into your overall planning.”

Having planned ahead, it’s easier to make any adjustments necessary depending on the level to which a woman is affected by the menopause and any other life course events happening, such as taking care of sick parents or children going to university.

Married women or those with partners may also want to consider the role their spouse or partner can play in financial planning. Can they increase contributions to savings and pensions? Or would it be more efficient for them to liquidate certain assets?

How can employers help?

Bishop also highlights the importance of taking into account what your employer offers from a financial perspective. “Do they provide private medical support or income protection, for instance? See what benefits are available and then consider whether to take out additional forms of cover to top things up.”

The menopause is increasingly being recognised by employers as a health issue they should be providing support for. “Workplaces need to consider employment-based options for women going through the menopause,” says Evandrou. “Is there flexibility to work from home? Can you do a senior management job part-time? Could you have unpaid leave for a year and then come back? This not only supports the woman but means that businesses don’t lose highly-skilled valuable talent.”

What comes next?

“Having a financial plan in place means that once you’re actually experiencing the menopause, you’re not having to worry about paying the bills, and if you need the time out, you know you can because you’ve planned for it,” says Bishop. “A common question I get asked by clients is a simple one – ‘Am I OK financially?’ Many want a high-level overview rather than delve into the fine detail. They just want to know somebody is looking after their investments and financial plan.”

And as Falkingham concludes: “While there is still stigma associated with the menopause, with more awareness, flexible employment options and a wider range of financial products, women, in ten or 15 years’ time, will be able to travel through the menopause in a slightly less bumpy way.”

Where can I find more on the menopause?

International Menopause Society

The value of investments, and any income from them, can fall and you may get back less than you invested. Tax treatment depends on the individual circumstances of each client and may be subject to change in the future. You should always check the tax implications with an accountant or tax specialist. Information is provided only as an example and is not a recommendation to pursue a particular strategy. Information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness.

Tagged with

Take control of your finances

We’ll help you prepare for the future and meet your goals with a solid financial plan that’s tailored to you.

Financial advice