Four reasons to invest in an ISA this year

Investing Views & insightsMaking the most of your ISA allowance today could boost your chances of a secure financial future. Here are four reasons why.

22 April 2024 | 3 minute read

The new tax year has begun, bringing with it a fresh ISA allowance that enables you to invest more of your money tax efficiently.

For the 2024/25 tax year, the ISA subscription limit is once again £20,000. Many people wait until the end of the tax year to fill up their ISA, but the sooner you act, the better your chances are of realising your financial goals.

|

|

||

Download: A guide to tax-efficient investingFind out how to invest more tax efficiently and reach your goals in our comprehensive guide |

||

Here are four reasons to invest in an ISA this year.

1. Greater potential for long-term growth

Investing in an ISA early on gives your money the opportunity to produce tax-free returns over a longer period. This is especially important in a high inflationary environment. Although interest rates have risen over the past year, savings held in cash will tend to lose value over the long term due to inflation eroding its purchasing power.1

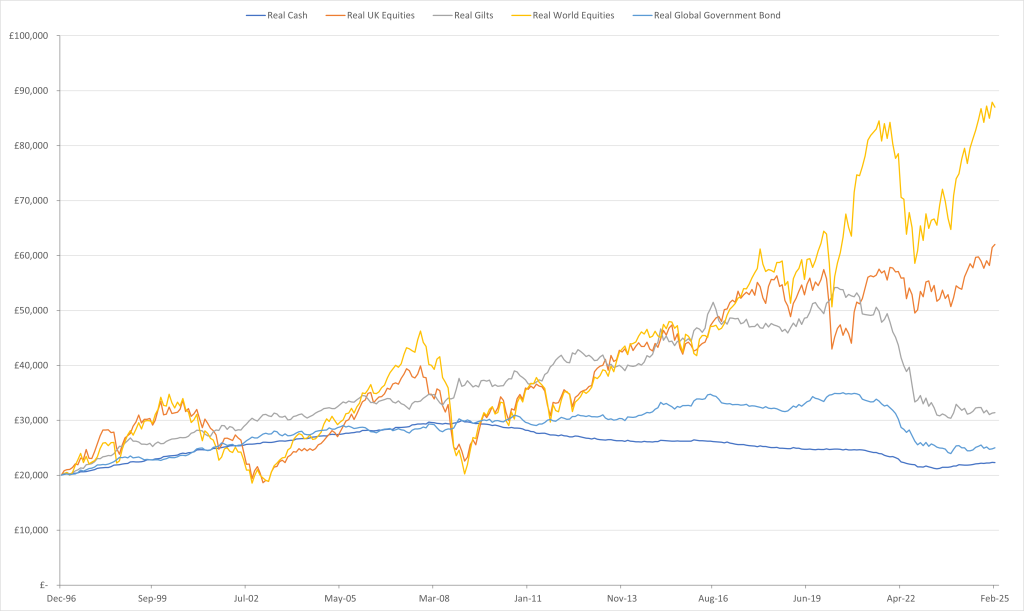

The graph below shows how different asset classes have performed compared to cash. Any balanced portfolio consisting of a mix of stocks and bonds, for example, would have typically outstripped cash returns by a good margin over the long term. Of course, investing comes with more risk than holding your money in a cash account, your investments may lose as well as gain value, and there are fees to consider. The best way to preserve your portfolio over the long term is to diversify your investment.

Source: RBC Brewin Dolphin / LSEG Datastream

Neither simulated nor actual past performance are reliable indicators of future performance. Performance is quoted before charges which will reduce illustrated performance.

2. Tax-efficient growth and income

The reason why investing through an ISA is especially powerful is that your investments can grow free of tax. If you hold investments outside an ISA, you’ll pay capital gains tax (CGT) at up to 20% on the profits (‘gains’) you make above your CGT exemption once you are above the basic tax rate. The annual CGT exemption was slashed from £6,000 to £3,000 on 6 April for the 2024/25 tax year. This has made it even more important to look for ways to grow your money tax efficiently.

If your investments generate income – for example, dividends from shares or interest from bonds – this is also tax free when inside an ISA. The annual dividend allowance was cut from £1,000 to £500 on 6 April for the 2024/25 tax year; again, this makes ISAs an even more valuable tax planning tool than they were in the past.

3. Choice between lump sum and regular investing

If you have a large lump sum of money ready to go, investing it in an ISA early on will give it the opportunity to grow tax efficiently over a longer period. You might, however, prefer to invest your money gradually over several months. Known as ‘drip-feeding’, this may help to reduce the impact of a sudden market downturn on your portfolio.

Even if you don’t have a lump sum, you could make the most of the new tax year by setting up monthly Investment ISA contributions. This is a great way of ensuring you’re consistently saving for your future, and it removes the temptation of trying to time the market, which is a strategy that is fraught with greater risk. Setting up a standing order makes this process simpler and means there is one less thing for you to remember.

4. ISAs have a ‘use it or lose it’ allowance

The ISA allowance is a ‘use it or lose it’ allowance, which means you can’t carry it forward to the next tax year. By taking advantage of your allowance earlier in the tax year, you won’t face any last-minute decisions when 5 April 2025 approaches. Whether you prefer to invest your full £20,000 allowance in one go or drip feed it each month, having a plan in place will help you invest in a way that suits your individual needs.

Next steps

An Investment ISA is a great way to save money for your future, but it isn’t always easy to decide how much to set aside, when to invest, and how to build an investment portfolio that is right for you. Taking some financial advice will give you the confidence that you’re doing the right thing with your money, so you can focus on enjoying life today.

1 https://www.fca.org.uk/investsmart/should-you-invest

|

|

||

Get financial planning tips straight to your inboxSign up to our newsletter for expert insights on investing for the future, saving for retirement, passing on assets to the next generation, and much more. |

||

The value of investments, and any income from them, can fall and you may get back less than you invested. This does not constitute tax or legal advice. Tax treatment depends on the individual circumstances of each client and may be subject to change in the future. Neither simulated nor actual past performance are reliable indicators of future performance. Information is provided only as an example and is not a recommendation to pursue a particular strategy.

Tagged with

Take control of your finances

We’ll help you prepare for the future and meet your goals with a solid financial plan that’s tailored to you.

Financial advice