Could you be sleepwalking into an IHT bill?

Inheritance and estate planning Views & insightsOur research of 7,000 people found that many families risk leaving behind a smaller financial legacy than they intended to

18 June 2024 | 3 minute read

Failure to plan and a reluctance to talk about money mean many families could risk sleepwalking into an inheritance tax (IHT) bill and leaving behind a much smaller financial legacy than they intended to.

|

|

||

Download: A guide to inheritance tax planningEverything you need to know about leaving a tax-efficient legacy for your loved ones. |

||

Our research found that wealthy families could be leaving their loved ones with a 40% tax charge on inherited assets, despite there being a whole host of exemptions to mitigate this so-called ‘death tax’.

Families in the UK paid a record £7.5 billion in IHT in the financial year 2023-2024 – nearly double the £3.83 billion paid in 2014-15. The increase is partly due to frozen IHT thresholds – the IHT nil-rate band hasn’t risen since 20092 – as well as rising property prices over the past decade.

However, our research also revealed that many people who are relatively wealthy haven’t taken financial advice around IHT, nor discussed their plans with their family.

Families are failing to plan ahead

We commissioned a survey3 of 7,000 people – 2,000 of whom were over-55 with children, and 5,000 of whom were under-55 with living parents – to understand the attitudes between different generations around inheritance.

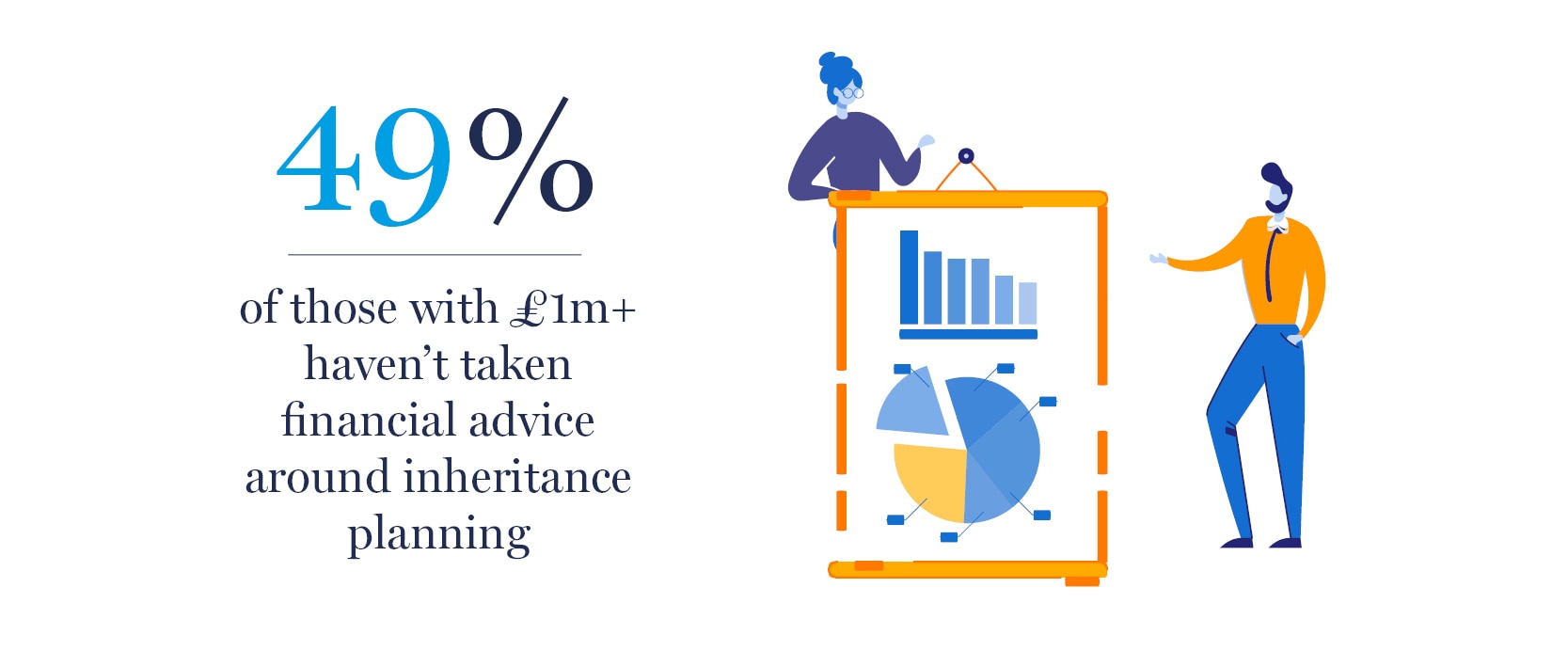

Our research found that more than two-thirds of those aged 55+, all of whom had dependants, had not taken financial advice around inheritance planning. Not everyone will be affected by inheritance tax, but even among respondents with £1m or more in savings and investments, and who therefore would be affected, half had not taken advice.

We also found that many parents and children are not talking to each other about estate planning. More than two-fifths of parents and three-quarters of adult children said they hadn’t discussed plans to pass on money.

Meanwhile, almost a third of respondents with £1m+ in savings and investments expect to pass on money when they die, despite this being one of the least tax-efficient ways to pass on wealth.

Understanding inheritance tax

Leaving money to your children or grandchildren through your will when you die might seem a natural choice. But if your estate is valued at above the IHT nil-rate band of £325,000, the excess will be liable for inheritance tax of 40%.

There is an additional IHT allowance called the ‘residence nil-rate band’. To qualify, you must pass on your main residence (or the sale proceeds of it) directly to your children or grandchildren when you die. The residence nil-rate band is currently only £175,000 and is tapered if your estate exceeds £2m.

Overall, you could potentially pass on a maximum of £500,000 before IHT kicks in. It’s possible to transfer any unused element of your IHT allowances to your living spouse when you die, which effectively doubles the limit to a maximum of £1m. Soaring house prices mean that many more families could have estates that exceed the threshold than in the past.

How to mitigate IHT

There are several ways to mitigate IHT – but only if you plan ahead. What’s right for you will depend on your individual circumstances and it’s important to seek financial advice. Some of your options could include:

1. Gift money while you’re still alive

Making lifetime gifts is not only tax efficient, but also allows you to see your loved ones benefit from your wealth. There are a range of gifting allowances available, including gifts of up to £3,000 each tax year (your ‘annual exemption’), gifts for weddings or civil partnerships, and gifts from regular income. Larger gifts are known as ‘potentially exempt transfers’ and you must survive for at least a further seven years for them to be tax free.

2. Pass on money through pensions

Pensions usually fall outside your estate and so can be passed on to your beneficiaries free from IHT. The abolition of the pension lifetime allowance tax charge means you could potentially build up a larger pension pot and then pass on more wealth to the next generation free of IHT.

3. Use trusts

If you put assets into a trust, the assets no longer belong to you and instead belong to the trust. This means they won’t form part of your estate when calculating IHT. However, you must meet strict conditions, so it’s crucial to get professional advice. Another benefit of trusts is they can give you control over how your assets are used by future generations – this might be useful if you’re concerned your children or grandchildren won’t use the funds wisely.

4. Consider life assurance

A whole-of-life policy can help to meet or reduce a prospective IHT bill. As long as the policy is written in trust, the proceeds won’t be included in your estate. When you die, the policy pays out to the trust, which then pays all or part of the IHT bill.

Other potential ways to reduce IHT include discounted gift trusts and specialist investment vehicles – an adviser can explain whether these may be suitable for you.

Next steps

A carefully considered estate plan could enable you to make a real difference to the lives of your children and grandchildren. However, as our survey found, many families are failing to plan ahead, which means the legacy they leave behind might not be as valuable as they intended it to be. Estate planning can be complex – there’s no ‘off-the-shelf’ solution – which is why it’s important to speak to a financial adviser. They can provide the ideas and solutions you need to build a robust, tailored estate plan that suits your needs and lays firm foundations for your family’s future.

1 HMRC IHT receipts

2 HMRC IHT thresholds

3 Find Out Now survey, March to April 2023

|

|

||

Get financial planning tips straight to your inboxSign up to our newsletter for expert insights on investing for the future, saving for retirement, passing on assets to the next generation, and much more. |

||

The value of investments, and any income from them, can fall and you may get back less than you invested. This does not constitute tax or legal advice. Tax treatment depends on the individual circumstances of each client and may be subject to change in the future. Information is provided only as an example and is not a recommendation to pursue a particular strategy. Information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness.

Tagged with

Is your legacy tax efficient?

We can help you pass on your assets securely and efficiently to the people you care about.

IHT planning