2025 outlook: Tensions, trends and transformations

Economics Views & insightsChief Strategist, Guy Foster, considers the economic outlook for 2025 and identifies the trends and companies set to define the next twelve months and beyond.

11 December 2024 | 12 minute read

Key highlights

- The outlook for global stocks: the global equity index is poised for a robust finish this year, but gains have not been evenly distributed. The U.S. market has surged ahead, while Europe and emerging markets have lagged.

- Tensions continue: 2025 is expected to be dominated by debates over taxes and public spending, driven by rising budget deficits and high borrowing costs. This will make it challenging for new governments to keep election promises.

- An ageing world: the rise in life expectancy has led to increased emphasis on self-care and preventative care, but government healthcare budgets face pressure.

- The role of artificial intelligence (AI): while AI has the potential to increase productivity and address public financing costs, it will be crucial to develop radical solutions to meet the growing burden of an ageing population.

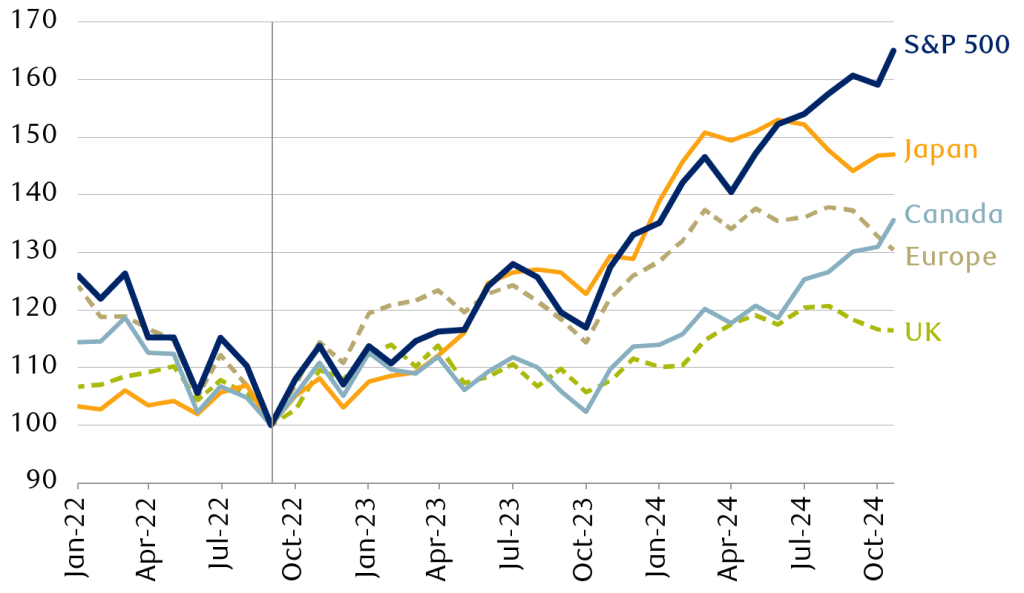

As another year draws to a close, equity investors will likely reflect upon 2024 as a strong year, with the global index poised for a robust finish. However, the gains haven’t been evenly distributed.

The U.S. market has surged ahead, delivering nearly twice the returns of major regions like the UK, Japan, and Asia Pacific. The laggards? Europe and emerging markets.

Major indexes have seen two years of ‘up’

Equity index performance relative to September 2022

Even within the U.S. it’s been a tale of two markets.

While the overall market has performed well, the top seven companies – dubbed the ‘Magnificent Seven’ – are on track to return significantly more. This group includes Alphabet (Google), Amazon, Microsoft, Tesla, Meta (Facebook, Instagram and Whatsapp), and Nvidia, which are poised to outperform the rest of the market by nearly double.

Will 2025 offer more of the same?

According to the IMF’s World Economic Outlook, 2025 is expected to resemble this year, with the global economy projected to grow by 3.2%. Meanwhile, inflation is expected to edge back to target, which is encouraging. If the economy continues to grow, then we’re more likely to see stocks continue to provide good returns.

Despite the IMF’s forecast, their economists aren’t infallible. Recessions often result from unpredictable economic shocks such as sharp price increases in essential commodities like oil or gas, or sudden changes in consumer spending behaviour. The Covid-19 lockdowns or the great financial crisis are extreme examples.

Tensions in the Middle East mean it would be unwise to rule out an oil price spike. However, the outlook for oil is tepid due to weak demand, partly driven by China’s struggling economy and a potentially stronger supply from the U.S. — remember Trump’s promise to “drill baby drill”? Whether his words represent a policy or mere rhetoric remains to be seen, but U.S. oil supply has diluted the world’s reliance on Middle Eastern oil along with OPEC’s ability to control oil prices.

While oil is the most likely source of sharp increases in prices, inflation could still be a headwind for investors. In recent months, there have been signs that inflation is more stubborn in some economies, most notably the U.S.

Lingering inflation has tempered anticipation of interest rate reductions. Falling rates would boost the stock market, but it can typically cope with static or modestly rising rates (in the absence of price shocks).

Deficit – an early prediction for 2025’s word of the year?

Higher interest rates are symptomatic of a theme which seems set to dominate 2025: debates over taxes and public spending.

As 2024 draws to a close, France is in a state of political crisis. It’s now expected to borrow over 6% of its GDP in the current fiscal year. High borrowing during the pandemic, combined with high interest rates which make that debt more expensive, have stretched the public finances of many countries (including the UK). However, France’s challenges are compounded by its membership of the common currency area and the weakness of its political position.

In 2024, nearly half the world’s population participated in elections in over 100 countries. In most cases, the incumbents lost as voters expressed their frustration with inflation, higher borrowing costs, and creaking public finances. This tricky environment is likely to make it difficult for new governments to keep election promises, as seen in the UK’s Autumn Budget, which included significant tax increases and borrowing.

Many countries are grappling with substantial budget deficits, which will become increasingly difficult to manage at current interest rate levels. Government attempts to address these deficits will likely incur higher borrowing costs, as seen recently in France and the UK’s 2022 mini-budget debacle, which was hastily abandoned.

But it’s not just the pandemic that’s led to a rise in public spending – we’re living longer.

Meeting the needs of an ageing population

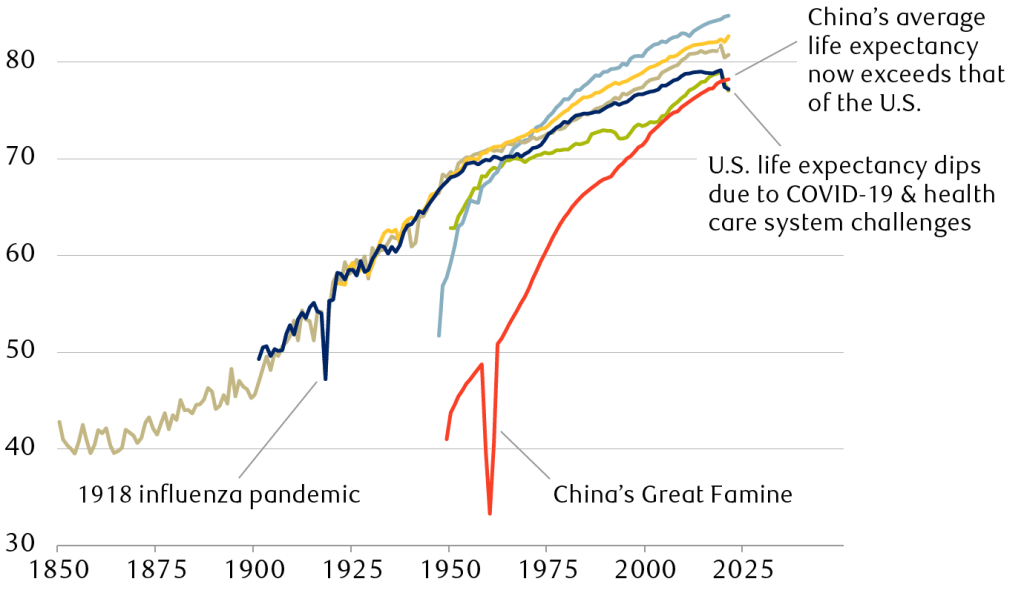

As our population ages, we’re seeing more people in retirement, drawing pensions and fewer people in employment. This shift has been driven by remarkable medical and social progress over the past 150 years. Life expectancy has more than doubled thanks to advances in healthcare, and infant mortality has plummeted due to cleaner water, better nutrition, and greater access to vaccines and antibiotics. Today, children born in developed nations can expect to have an even chance of living past their 80s. The age of longevity has begun.

Longevity will not only significantly impact 2025, but the next decade and beyond. We can expect to see rising pressure on public finances and increasing needs for efficient and effective healthcare solutions.

Life expectancy at birth since the 1850s

The rise in life expectancy has led to an increased emphasis on self-care and preventative care. However, government healthcare budgets face pressure, prompting policies that encourage the use of over-the-counter (OTC) medications. These are paid for by consumers out of pocket, without government reimbursement.

As with any megatrend, there are companies positioning themselves to serve an ageing population:

- Haleon: companies like Haleon, which owns well-known brands in several age-related health categories, are beneficiaries of the rise in OTC medication. Its products for arthritis pain relief, denture care, and a multivitamin formulated to offer nutritional support to adults over 50, are tailored to older consumers.

- Nestle Health Science: the emergence of GLP-1 weight loss drugs will both extend lives and reduce the incidence of chronic conditions in later life. Nestle’s Health Science division is addressing some of the key physical challenges this poses with products that support the nutritional needs of GLP-1 consumers.

- Stryker: a 2022 UK study estimated that demand for hip and knee replacements will increase by almost 40% by 2060, with consumers wanting to remain active further into their retirement. Immobility can lead to many complications, including pressure injuries, pneumonia, venous thromboembolism, and urinary tract infections – to name just a few. This provides a robust tailwind for the medical technology company, Stryker. It offers the market’s leading hip and knee implants and provides robotic arm-assisted technology and data analytics for orthopaedic services. Stryker has also expanded through strategic acquisitions into medical and surgical equipment, neurotechnology and digital healthcare.

- Alcon: unfortunately, ageing inevitably leads to eyesight problems, such as cataracts, presbyopia, and dry eyes. Cataracts affect nearly 93% of those over 80, while presbyopia affects over 85% of those aged over 45. Alcon is the largest company in ophthalmic surgery offering a complete range of cataract, retinal, glaucoma, and refractive surgery products. It’s also the second largest manufacturer of contact lenses, and the largest manufacturer of contact lens care products and products for dry eyes. Expenditure on eyecare generates a relatively high return, as most causes of visual loss are reversible and it has a disproportionate impact on productivity and care requirements.

- Novartis: as people age, their healthcare needs obviously go beyond OTC remedies and preventative measures. Frailty increases, muscles and bones weaken, and chronic illnesses like cancer, diabetes, and heart disease become more common. This creates a steady growth market for innovative pharmaceuticals, which global drug developers like Novartis are addressing. Novartis researchers are working on novel treatments to address age-related illnesses at their Diseases of Ageing and Regenerative Medicine group (DARe). These treatments include experimental medicines to regenerate lost hearing and tissue, as well as strengthen weakened muscles.

With the conveyor belt of products to extend and enhance later life continuing to roll, even as some breakthroughs reduce costs, the rise of healthcare expenditure seems unstoppable.

The price of longevity

Financing healthcare expenditure will be a major challenge for governments. This most political of topics is one many parties are reluctant to address head on, which is deeply regrettable.

Longevity means an increasing burden of those out of work, falling on those in work. Governments may consider pushing back state retirement ages to support public finances, but this is a contentious issue. Ultimately, a more radical rethink of how these costs could be met will be necessary.

In the U.S., President-elect Trump has tasked two entrepreneurs, Elon Musk and Vivek Ramaswamy, to lead a Department of Government Efficiency to reduce government spending. Even these creative thinkers are really just looking at radical ways of trimming conventional expenses. Past attempts to increase public sector efficiency have been hindered by legal, organisational and political factors, so it’ll be interesting to see how they get on. Rather than assuming taxes will continue to increase ad infinitum, it seems more likely that the topic becomes more of a focus of policymaking.

Can AI cure a creaking system?

The growing use of AI could be decisive in determining how public financing costs are met. With its potential to increase productivity from a shrinking workforce, AI could be restorative for public finances – the effects are just hard to model.

Inevitably, spending on AI will accelerate from today’s already lofty levels, driven by tech companies’ desire to stay competitive. Just look at Microsoft, its annual AI spending has tripled since 2020, reaching nearly $60 billion.

Non-tech businesses are also ramping up AI investment to maintain competitive cost structures. Take global consulting company, Accenture, its AI bookings reached over $2 billion in the first three quarters of their 2024 fiscal year, a significant jump from $300 million in all of fiscal 2023.

Yet it will be tech behemoths like Microsoft, Amazon and Google that will likely benefit from AI development the most. Largely in three key ways:

- They facilitate the development of AI through their dominance of the cloud computing industry.

- They each have access to enormous volumes of data which AI will thrive upon.

- They can incorporate AI tools directly into their products.

However, the brain matter of AI are semiconductors, and Nvidia’s dominance in their production has driven it to the highest echelons of the global stock market. But Nvidia is only one part of a semiconductor supply chain that stretches from chip design through to manufacture. This includes companies like ASML in the Netherlands, which builds extreme ultraviolet lithography machines for chip manufacturing. These allow the precise etching of miniaturised integrated circuits that drive more advanced and efficient digital processes.

So the chain continues: as healthcare developments improve and extend our lives, they also create an additional burden on governments and individuals. Meanwhile, AI helps us to overcome the challenges of a potentially declining workforce while boosting productivity.

More innovation means more energy

To support an AI-driven productivity boom, energy demands are likely to rise and increasing energy costs pose both environmental and economic challenges (in the form of inflation). However, technology has also been addressing these challenges.

In our view, renewables are set to become the dominant source of power. Initiated by government subsidies over two decades ago, the rapid installation of wind farms, solar collectors, and energy storage facilities have driven the cost of renewable power (without subsidies) down to levels that could soon make it the lowest-cost energy source in many countries. In fact, costs per kilowatt hour from renewables have plummeted to a degree not previously imagined two decades ago. As a result, nearly a quarter of U.S. electricity now derives from renewables, close to one-third in China, and 46% in the UK, as of 2023, according to Our World in Data.

Despite renewable power’s impressive growth, investing in it has been challenging. This is because installing it requires significant upfront investment, with returns coming much later. In a market awash with highly profitable cash generative beneficiaries of AI, renewables remain in the shade.

However, renewable energy remains crucial for addressing the challenges posed by an ageing society and advancing technology. Yet, as workforces decline and companies invest in AI-driven solutions, inflation is expected to remain a challenge in the coming years.

Please note: The information provided should not be mistaken for formal planning advice; it is imperative that you seek relevant advice for your own personal circumstances. RBC Brewin Dolphin do not provide tax or legal advice and we would recommend that you seek appropriate advice in these areas. Rates of tax will be based on individual circumstance and tax rules are subject to change. The value of investments, and any income from them, can fall and you may get back less than you invested. Neither simulated nor actual past performance are reliable indicators of future performance.

The value of investments, and any income from them, can fall and you may get back less than you invested. This does not constitute tax or legal advice. Tax treatment depends on the individual circumstances of each client and may be subject to change in the future. Neither simulated nor actual past performance are reliable indicators of future performance. Investment values may increase or decrease as a result of currency fluctuations. Information is provided only as an example and is not a recommendation to pursue a particular strategy. Forecasts are not a reliable indicator of future performance. We or a connected person may have positions in or options on the securities mentioned herein or may buy, sell or offer to make a purchase or sale of such securities from time to time. For further information, please refer to our conflicts policy which is available on request or can be accessed via our website at www.brewin.co.uk. Information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness.

Tagged with

Ideas Happen Here

Let’s build your financial future so you can focus on what really matters. Contact us for help with financial planning and investment management.

Book a call back