Millions’ plans for retirement hinge on ‘lifestyle’ pensions that may not be suitable for them and they don’t understand – new survey

News & comments27 August 2024

Despite the fact that many people’s plans for retirement will rely on a ‘lifestyle’ pension fund, new research suggests the vast majority of savers do not know what they are or how they work.

A survey conducted by RBC Brewin Dolphin, the wealth manager, found that 75% of respondents do not know what a lifestyle pension fund is and 64% are unaware of the approach they – and similar products – take to setting you up for retirement.

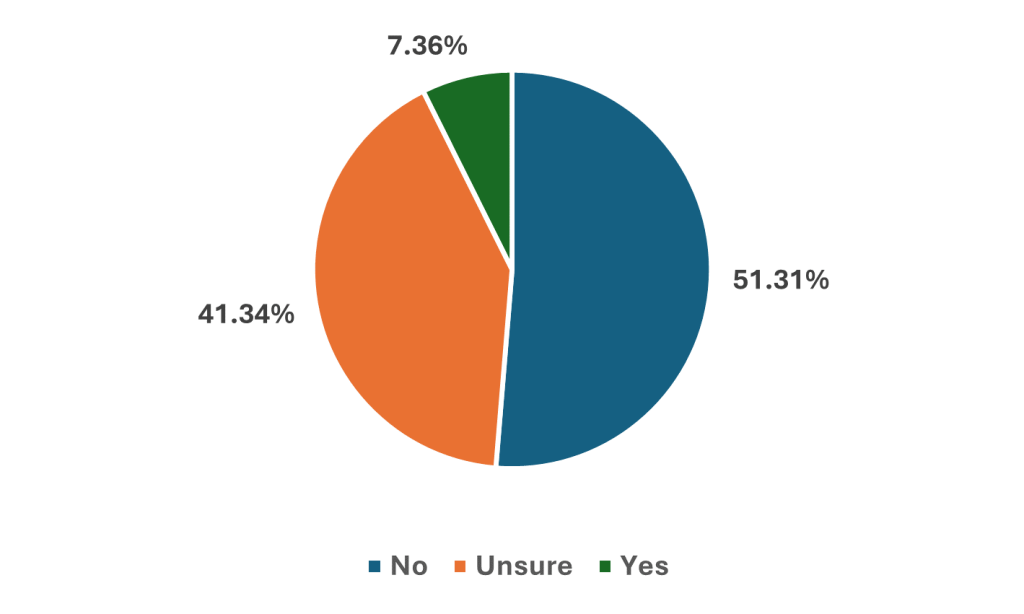

Lifestyle pensions were originally designed to give people enough cash at retirement to buy an annuity. Yet, 92% of those surveyed by RBC Brewin Dolphin said they either do not plan to purchase an annuity or were unsure of whether they wanted to (51% and 41%, respectively).

Figure one: Do you plan to buy an annuity with your pension pot?

Source: RBC Brewin Dolphin, Findoutnow

Beginning in higher-risk investments, such as equities, lifestyle strategies move into assets deemed to be low risk the closer you are to retirement. While you might start with an 80% to 20% split in equities to fixed-income products, by retirement your pension may only be made up of bonds and cash, or completely in the latter.

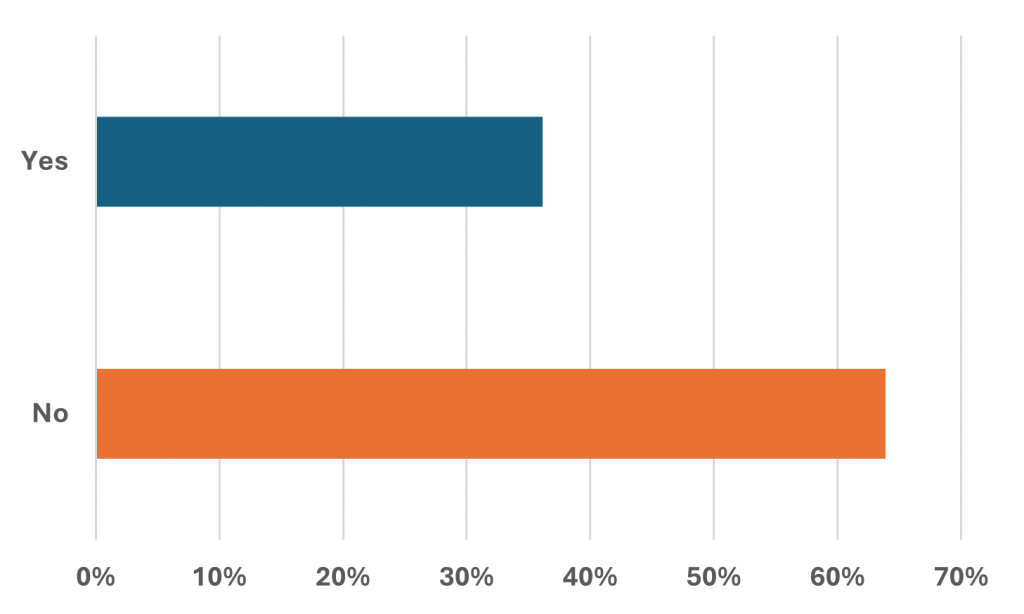

Figure two: Are you aware that some pension funds (e.g. lifestyle pension funds) transition to low-risk assets and cash ahead of your retirement date?

Source: RBC Brewin Dolphin, Findoutnow

While 90% of respondents said they knew who their pension provider was, just 40% were aware of what their pension was actually invested in. Around 10 million people are in lifestyle funds, or equivalents, through the UK Government-backed Nest scheme alone1.

Daniel Hough, financial planner at RBC Brewin Dolphin, said: “Lifestyle pensions usually start to de-risk – in other words, transitioning from equities to bonds and cash – about 10 years from your retirement date. But, by that stage, ideally you should have no liabilities, no financial dependents, and you would be in a position to increase your pension contributions to give it the best chance of growth – that isn’t going to happen if your pot is largely made of bonds and cash.

“As our survey shows, most people do not know what lifestyle pensions are or how they work. We’ve started receiving a lot of questions about these funds and whether they are suitable. In one case, someone came to us because their pension had grown by just 4% over five years right before they were set to retire – the fund had been in 95% cash for four of those years, but it wasn’t clear to them that’s how their pension was set up.

“Lifestyle funds are potentially still relevant to people who want to buy themselves an annuity. But, doing that has become a lot less common in recent years, particularly with the changes to pension death benefits which mean that it is not counted as part of your estate when you pass away.

“If your circumstances allow it, your pension should remain invested, you can take the natural yield from these assets as income, and when the time comes it can be passed down to your family members. Lifestyle pensions can stop your fund from growing right when you could be benefitting most.”

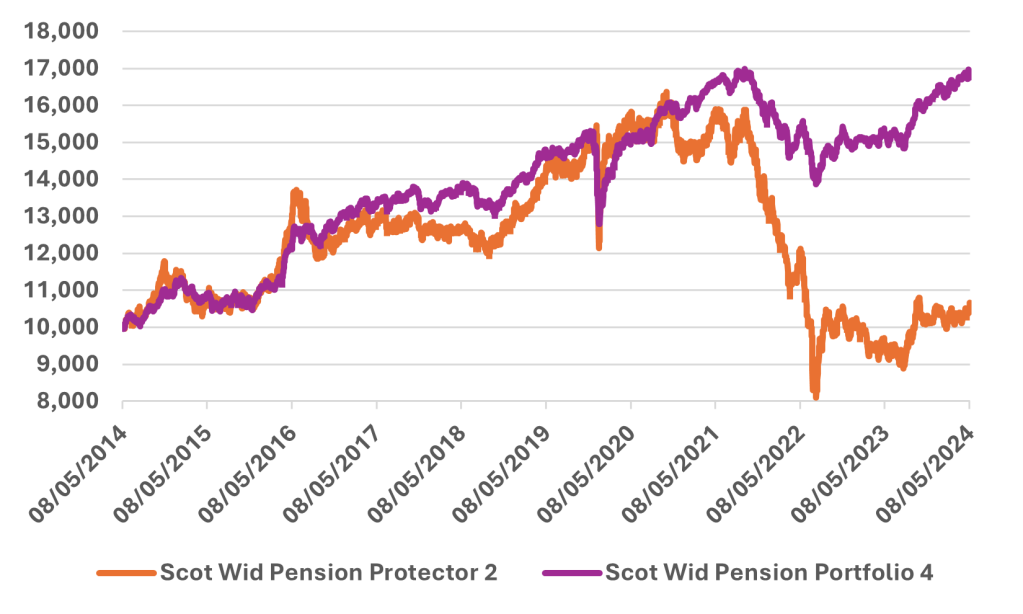

Figure three: Scottish Widows Pension Protector 2 vs Scottish Widows Pension Portfolio Four Pension Series 4, ten-year performance

Source: Refinitiv

Many of these funds have been labelled as low risk, but rising interest rates during 2022 and 2023, coupled with falling bond prices, meant many lifestyle funds saw the value of their assets fall precipitously and are yet to recover.

The £1.2 billion Scottish Widows Pension Protector Series 2 pension fund, which ‘de-risks’ ahead of an annuity purchase and is almost entirely made up of bonds and money market funds2, is more or less flat over 10 years (see figure three).

By comparison, Scottish Widows Pension Portfolio Four Pension Series 4, which contains a broader spread of investments including equities3, has returned to its previous peak of early 2022.

Most funds that found themselves highly exposed to bonds in the build up to 2022 have little hope of recovery, unless base rates return to the lows of between 0.1% and 0.5% during March 2009 to February 2022, which appears unlikely to happen anytime soon.

Rob Burgeman, senior investment manager at RBC Brewin Dolphin, said: “Lifestyle funds were designed in a time when most people saving for retirement would buy an annuity, when the reality is somewhat different for many savers today.

“Certainly, when bond and gilt prices were kept high by low base interest rates, these funds ‘locked’ savers into anomalously and historically low annuity rates. So, what they have turned out to offer is return-free risk, as anyone retiring in the past two years has probably discovered. That is far from what they believed they were buying.

“A lot has changed since the Covid-19 pandemic and lifestyle funds have turned out to be at higher risk of not achieving their goals for retirement, leaving anyone on the cusp of retirement with a hole blown in their pension pots and little opportunity to rebuild the capital. In all truth, they will likely take a very long time to make that money back, if it ever happens.

“I have heard about a number of cases in the past couple of years – but there are probably thousands out there. Each one underlines the importance of seeking professional financial advice to understand the investments you are basing your retirement plans on and what the risks involved could be.”

Disclaimers

The value of investments, and any income from them, can fall and you may get back less than you invested.

This does not constitute tax or legal advice. Tax treatment depends on the individual circumstances of each client and may be subject to change in the future.

Neither simulated nor actual past performance are reliable indicators of future performance.

Performance is quoted before charges which will reduce illustrated performance.

Information is provided only as an example and is not a recommendation to pursue a particular strategy.

We or a connected person may have positions in or options on the securities mentioned herein or may buy, sell or offer to make a purchase or sale of such securities from time to time. For further information, please refer to our conflicts policy which is available on request or can be accessed via our website at www.brewin.co.uk.

Information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness.

RBC Brewin Dolphin is a trading name of Brewin Dolphin Limited. Brewin Dolphin Limited is authorised and regulated by the Financial Conduct Authority (Financial Services Register reference number 124444) and regulated in Jersey by the Financial Services Commission. Registered Office: 12 Smithfield Street, London, EC1A 9BD. Registered in England and Wales company number: 2135876. VAT number: 365345640.

1 Source: Nest

2 Source: Trustnet

3 Source: Trustnet

– ENDS –

Findoutnow surveyed a nationally representative sample of 2,000 people in the UK who have pensions between August 5th and 6th 2024.

PRESS INFORMATION

For further information, please contact:

Peter McFarlane: peter.mcfarlane@framecreates.co.uk / Tel: 07412 739 093

Siân Robertson: Sian.Robertson@brewin.co.uk / Tel: +44 (0) 20 3201 3026

Payal Nair payal.nair@brewin.co.uk / Tel: +44 (0) 20 3201 3342

NOTES TO EDITORS

About RBC Brewin Dolphin

RBC Brewin Dolphin is one of the UK and Ireland’s leading wealth managers and traces its origins back to 1762. With £57.1bn* billion in assets under management, we offer award-winning, bespoke wealth management services, including discretionary investment management and financial planning.

Our qualified investment managers and financial planners are based in 33 offices across the UK, Jersey and Republic of Ireland. They are committed to the most exacting standards of client service, with long-term thinking and absolute focus on our clients’ needs at the core.

As part of Royal Bank of Canada (RBC), we are now able to draw on the strength of a global financial institution to continue to improve the service we provide to our clients and drive further innovation across our business.

*as at 30th April 2024.

Disclaimers

The value of investments can fall and you may get back less than you invested.

RBC Brewin Dolphin is a trading name of Brewin Dolphin Limited. Brewin Dolphin Limited is authorised and regulated by the Financial Conduct Authority (Financial Services Register reference number 124444) and regulated in Jersey by the Financial Services Commission. Registered Office: 12 Smithfield Street, London, EC1A 9BD. Registered in England and Wales company number: 2135876. VAT number: 365345640.

About RBC

Royal Bank of Canada is a global financial institution with a purpose-driven, principles-led approach to delivering leading performance. Our success comes from the 94,000+ employees who leverage their imaginations and insights to bring our vision, values and strategy to life so we can help our clients thrive and communities prosper. As Canada’s biggest bank and one of the largest in the world, based on market capitalization, we have a diversified business model with a focus on innovation and providing exceptional experiences to our more than 17 million clients in Canada, the U.S. and 27 other countries. Learn more at rbc.com.