24 June 2020

High-growth tech companies are typically associated with the US stock market, but the Covid-19 crisis has seen their importance in the UK reach new heights, according to analysis from wealth manager Brewin Dolphin.

Shares in US tech companies such as Amazon and Microsoft have shown remarkable resilience in the year to date, as many of these corporations have played a growing role in helping households and businesses through the pandemic. The shares of both Amazon and Microsoft are at near record levels, while the S+P 500 remains below its February 2020 peak.

However, while UK investors looking for growth opportunities in tech normally look to the US, they could keep an eye on what is happening on British shores.

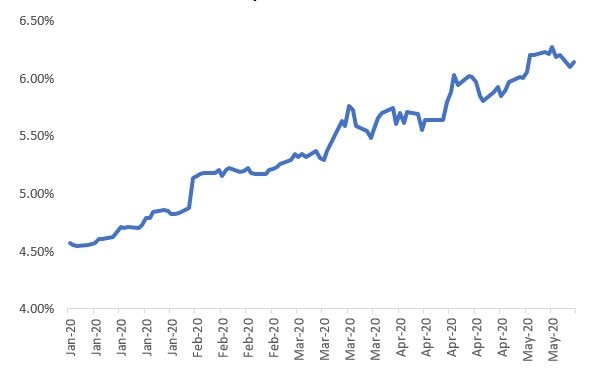

Brewin Dolphin found that the market value of tech and data companies on the FTSE 350 as a share of the market has risen significantly in 2020, increasing from 4.57% to 6.14% (chart 1). These businesses’ shares have proven robust, with just a -2% drop in total return (capital value and dividend), against a much greater fall in the wider market (chart 2).

Chart 1: Market value of UK tech companies as % of FTSE 350 YTD

Source: Thomson Reuters Datastream

Chart 2: Total return from UK tech companies and FTSE 350 index YTD

Source: Thomson Reuters Datastream

The FTSE 350 tech cohort takes in all businesses categorised as ‘software’, along with data-focussed companies such as Experian, the consumer credit reporting company; RELX, which owns specialist publishing businesses; and Ocado, the online grocery platform. Software businesses include Avast, the antivirus group; online property portal Rightmove; and Softcat, the IT infrastructure provider.

John Moore, senior investment manager at Brewin Dolphin, said: “When most people think of tech, they are immediately drawn to Facebook, Apple, Google, and other companies of that ilk, which are predominantly based in the US. However, there are opportunities to explore much closer to home and our analysis suggests that UK tech has proven resilient, becoming more prominent in the market following the Covid-19 pandemic.

“Amazon’s share price reached a record in the midst of the crisis and it is generally accepted that it has made the US tech companies’ role in business and society more ingrained. However, the same can be said for some UK-based tech enterprises, such as Ocado, which has also hit new heights this year.

“These are the sorts of companies that have grown up under the noses of many UK investors, but haven’t had the same attention lavished on them as some of their US counterparts. Of course, our advice is that these companies shouldn’t be held on their own – they should be part of a wider portfolio with exposure to a diverse set of sectors and geographies. Using a wealth manager can help investors put together a diverse portfolio of holdings, finding the best opportunities for you over the long-term, irrespective of the market cycle.”

Ways to gain exposure to UK tech:

Herald Investment Trust – Managed by Katie Potts since its inception in 1994, Herald Investment Trust invests in small and medium-sized companies in the UK, mainly from the technology, telecommunications, and services sectors – with smaller exposure to other geographies including the USA, China, Canada, and Australia. Among its top company holdings are GB Group, the Chester-based identity management, location intelligence, and fraud prevention company; technical products supplier, Diploma; and Future, the magazine publisher. John Moore said: “The Herald Investment Trust takes a very interesting strategy and, as a result, has generally delivered positive returns over more than two decades. To understand the trust, you need to look beyond its top 20 holdings – this is where its working capital sits. Most of the companies held in the trust are good but largely unrecognised, and it is great way of finding new tech companies coming out of the UK.”

IP Group – FTSE 250-listed IP Group is an intellectual property commercialisation business that invests in early to mature-stage companies in sectors ranging from technology to life sciences. Among its holdings are Accelercomm, which develops decoding solutions for 5G; the clean power business, Ceres Power; and Featurespace, a predictive analytics company. John Moore said: “IP Group is about building an investment portfolio and pipeline of IP-based assets. While the shadow of Woodford – who was a co-investor in many projects – hung over the company, a lot of work has been done over the last year to move forward. This higher than average risk company has recovery potential in addition to drivers from its underlying portfolio,”

Liontrust UK Smaller Companies – Liontrust’s UK smaller companies fund does exactly what it says on the tin: it invests in UK-based smaller companies. The £1 billion fund has 67 holdings spread across a variety of sectors, with around 16% focussed on software and computer services. Among its top holdings are unified communications services provider, Gamma Communications; DotDigital Group, the digital marketing software provider; and cloud-computing business iomart. John Moore said: “This fund has been focussed on IP investment for around 22 years. It has built positions in a wide range of truly interesting businesses that have the potential to grow bigger or compete with the best. Anthony Cross remains the driving force behind the fund, but an experienced team has been built around him and complementary mandates – such as Liontrust Micro-Cap – have been added making the overall proposition stronger.”

– ENDS –

Five-year discrete performance:

| Year | FTSE 350 | Tech |

| 2019 | 12.90% | 27.40% |

| 2018 | -15.40% | 17.90% |

| 2017 | 11% | 27.70% |

| 2016 | 8.90% | 16.30% |

| 2015 | -0.90% | 22.90% |

PRESS INFORMATION

For further information, please contact:

Peter McFarlane peter.mcfarlane@framecreates.co.uk / Tel: 07412 739 093

Richard Janes richard.janes@brewin.co.uk / Tel: +44 (0) 20 3201 3343

Anita Turland: anita.turland@brewin.co.uk / Tel: (0) 20 3201 4263

Payal Nair payal.nair@brewin.co.uk / Tel: +44 (0) 20 3201 3342

NOTES TO EDITORS

About Brewin Dolphin\

Brewin Dolphin is a UK FTSE 250 provider of discretionary wealth management. With £41.4* billion in total funds, it offers award-winning personalised wealth management services that meet the varied needs of our clients including individuals, charities and corporates.

We give clients security and wellbeing by helping them to protect and grow their wealth, in order to enrich their lives by achieving their goals and aspirations. Our services range from bespoke, discretionary investment management to retirement planning and tax-efficient investing. Our focus on discretionary investment management has led to significant growth in client funds and we now manage £35.7* billion on a discretionary basis.

Our intermediary business manages £12.5* billion of assets for over 1,700 advice firms either on a discretionary basis or via our Managed Portfolio Service.

In line with the premium we place on personal relationships, we’ve built a network of 33 offices across the UK, Jersey and Dublin, staffed by qualified investment managers and financial planners. We are committed to the most exacting standards of client service, with long-term thinking and absolute focus on our clients’ needs at the core.

*as at 31st March 2020

Disclaimers:

- The value of investments and any income from them can fall and you may get back less than you invested. Past performance is not a guide to future performance

- The opinions expressed in this document are not necessarily the views held throughout Brewin Dolphin Ltd.

- This information is for illustrative purposes only and is not intended as investment advice.

- We or a connected person may have positions in or options on the securities mentioned herein or may buy, sell or offer to make a purchase or sale of such securities from time to time. In addition, we reserve the right to act as principal or agent with regard to the sale or purchase of any security mentioned in this document. For further information, please refer to our conflicts policy which is available on request or can be accessed via our website at www.brewin.co.uk

- If you invest in currencies other than your own, fluctuations in currency value will mean that the value of your investment will move independently of the underlying asset.

- No investment is suitable in all cases and if you have any doubts as to an investment’s suitability then you should contact us.

- The information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness.

- Brewin Dolphin is authorised and regulated by the FCA (Financial Services Register reference number 124444)