Are your savings losing value?

Investing Views & insightsInflation could wipe hundreds of pounds off the real value of your savings. Here, we explain how to keep up with rising prices

16 May 2023 | 3 minute read

If you’ve been saving money for your long-term goals, you might think you’re on track for a secure financial future. Yet your financial security depends not only on how much money you set aside, but also on where you put it.

Inflation is a risk that many people fail to consider, but it could wipe hundreds of pounds off the real value of your savings. Without a solid financial plan in place, you could find that what seems like a large sum of money today is actually worth significantly less in ten years’ time.

|

|

||

Download: A guide to investingLearn how investing helps your money work harder in our jargon-free guide. |

||

Inflation – the silent thief

Inflation is often described as the ‘silent thief’ because of the way it can erode the real value of savings. Most of us notice when the price of everyday items increases. For example, back in January 1980, a pint of milk cost just 15p, whereas by March 2023 its price had grown to 70p, according to the Office for National Statistics1. If your savings aren’t keeping up with rising prices, their real value will decline.

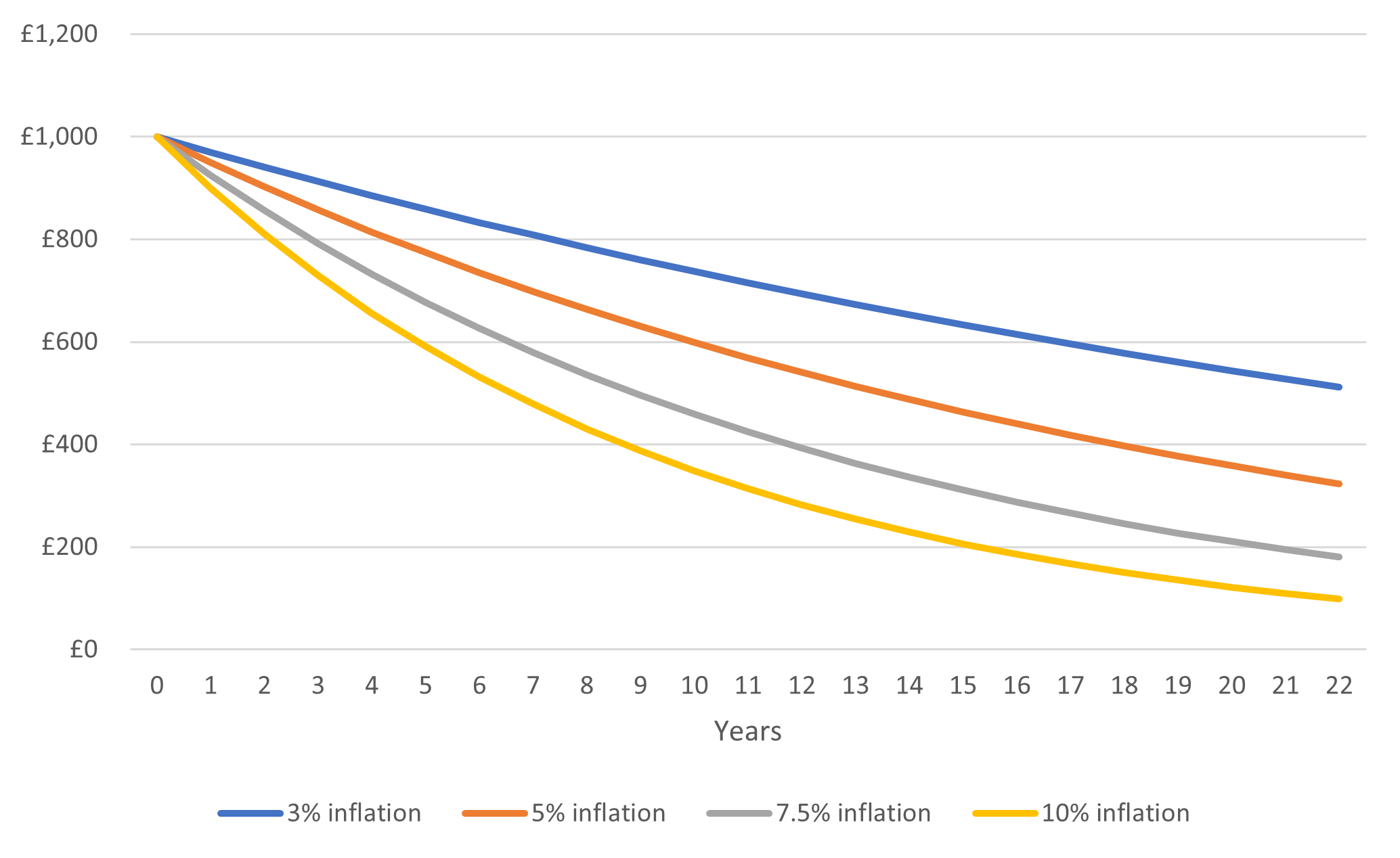

The chart below demonstrates the impact that inflation can have on the real value of £1,000 over two decades.

Impact of inflation over time

Source: RBC Brewin Dolphin. For illustrative purposes only.

Cash isn’t as risk-free as you think

Cash savings accounts are often deemed risk-free because they don’t expose money to investment risk. However, when it comes to long-term savings, they might not be as risk-free as you think.

The interest rates offered by cash savings accounts tend to be below the rate of inflation, which means the value of your money could be shrinking. Although interest rates have risen recently, they are still significantly below the annual inflation rate, which measured 10.1% in March 2023, according to the consumer prices index (CPI)2.

So, while cash savings accounts are useful for funding short-term goals and unexpected emergencies, you may wish to find another home for your longer-term savings. Otherwise, there’s a risk you’ll fall short of your savings goals, potentially jeopardising your plans for the future.

How to make your money work harder

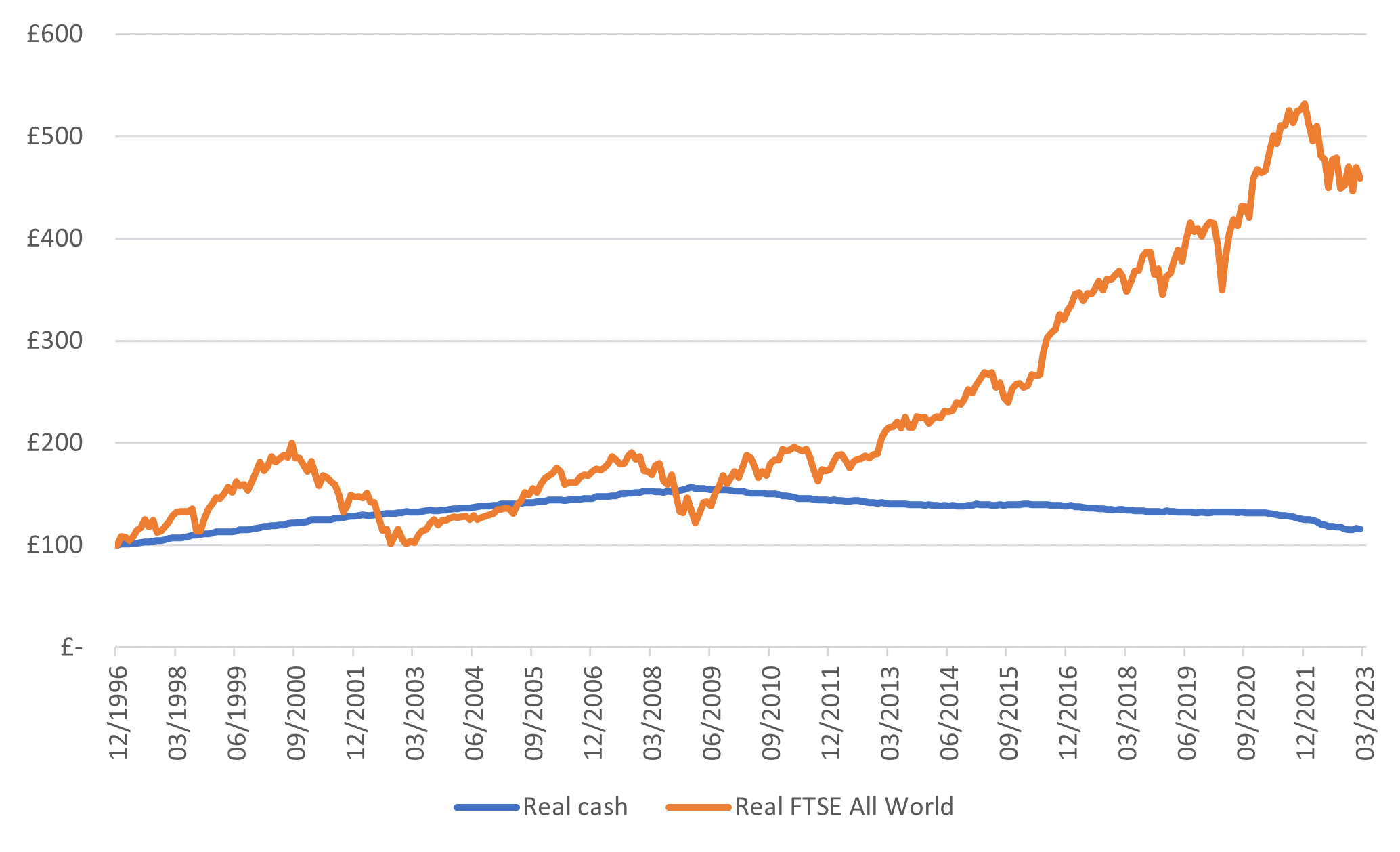

For savings over and above your emergency fund, it’s really important to look for ways to mitigate the impact of inflation over time. Although the stock market is volatile and investing comes with risks, history shows that over long periods it tends to perform more strongly than cash and above the rate of inflation.

The chart below shows that if you invested £100 in the FTSE All-World at the end of 1996, it would have increased in value to £459 by February 2023 on a ‘total real return’ basis (combining share price changes and dividend income, and adjusting for inflation). Conversely, if you had put £100 in a cash savings account, it would have grown to just £115 after adjusting for inflation3.

Equities vs cash – real returns

Source: RBC Brewin Dolphin / Refinitiv Datastream.

Neither simulated nor actual past performance are reliable indicators of future performance. Performance is quoted before charges which will reduce illustrated performance.

This period saw major economic downturns, including the bursting of the dot-com bubble, the global financial crisis, and the Covid-19 pandemic. Despite experiencing plenty of adversity over the past few decades, the stock market has continued to climb, given time.

Next steps

If you have time on your side, and enough cash set aside for emergencies, investing will give your money the greatest chance of growing and beating inflation over long periods. Getting started isn’t always easy, and that’s where getting some smart advice comes in. A financial adviser can help you create a portfolio that suits your needs, and works hard to preserve your money’s purchasing power and grow your investments over the long term.

1 https://www.ons.gov.uk/economy/inflationandpriceindices/timeseries/cznt/mm23

2 https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/consumerpriceinflation/march2023

3 Based on Bank of England base rate

The value of investments, and any income from them, can fall and you may get back less than you invested. Neither simulated nor actual past performance are reliable indicators of future performance. Performance is quoted before charges which will reduce illustrated performance. Information is provided only as an example and is not a recommendation to pursue a particular strategy. Information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness. Forecasts are not a reliable indicator of future performance.

|

|

||

Get financial planning tips straight to your inboxSign up to our newsletter for expert insights on investing for the future, saving for retirement, passing on assets to the next generation, and much more. |

||

Tagged with

Take control of your finances

We’ll help you prepare for the future and meet your goals with a solid financial plan that’s tailored to you.

Financial advice